Freelancing.HK-News 76

Dear readers,

Welcome to the second month of our fresh new year. We hope that you have had a good break and feel refreshed?

In our first article, we are fortunate to hear ‘words of wisdom’ from Jim of Jim’s Mowing and use his advice to consider some of the advantages and disadvantages of freelancing compared to franchising.

Our second article considers the advantages of freelancing as a way to go into business for the first time.

Then, we look at a report from Deloitte and consider how AI Agents are set to shake up the way we all interact with our computers and may potentially make Microsoft Word and Excel a thing of the past?

Financial security in old age is a particular challenge for freelancers. The OECD study ‘Pensions at a Glance’ shows the significant differences between the pension systems of different countries and their impact on freelancers. Find out how pension systems differ around the world and which countries are particularly freelancer friendly compared to Hong Kong.

Finally, our freelancer joke is quick, but speaks to the value of repeat business.

I hope you enjoy reading this and have a successful reminder of 2025!

Yours, Michael Barr

Are recessions better for business than booms?

“Recessions are better for us than booms” explains Jim; the founder of Jim´s Mowing, in his book "Every customer a fan". Apparently, this is because Jim´s have more work than they can handle and not enough franchisees. Fortunately for Jim´s, during recessions many middle-managers were given a golden handshake and with their new-found-wealth, invested it in a Jim´s franchise.

You can imagine their consternation, when Jim admitted to them that Jim´s Mowing was going broke: Ongoing franchisee fees had been priced too low and were not enough to fund the call centre. It was all the new money coming in from the sale of new Franchisee Agreements that had kept the business afloat. Jim explained that they would lose their investment unless they agreed to a hiking of their ongoing fees, which they reluctantly did. Apparently, since then, Jim´s has flourished?

Franchises are clearly a large upfront commitment, which can have a big payoff if done right. Another approach, with much lower costs, is by freelancing for work. When compared with buying a franchise, working with marketplaces like Freelancing.hk has the advantage of building up business, whilst keeping costs low. Along with a dramatically lower requirement for startup capital, lower ongoing costs means more income from your billable hours ends up in your pocket.

Opinion: Freelancing your way to a startup

You may have been itching to startup your own business, but haven’t known where to start? Maybe you held off, hoping something will turn up that ticks all the boxes, but it hasn’t happened yet and now you’re wondering whether it ever will?

Starting a business in Hong Kong is easy: You don’t even have to register a business name. In a sense, you are already running a business, because you are a legal entity that buys and sells. This type of business is called a Sole Trader and you are running it in your own name. Typically, you sell your services as an employee and buy things, such as a roof over your head.

In Hong Kong, my rule of thumb is 80% of businesses fail in the first year and of the survivors, 80% fail in the next four years. Pretty grim! I know it sounds weird to go into business to fail, but for a first business, this may be a winning strategy?

Look at it this way; work out a budget and set aside an amount of money you can afford to lose, whilst learning what works and what doesn’t. And here’s the big advantage: You already have skills you are selling in the marketplace. Even without a good idea to start a business, you can go into business by selling the skills you already have; as a freelancer!

What’s the worst that can happen?

As to why this is a winning strategy? Many people sink their life-savings into business, only to lose it all. However, if the amount lost was affordable, then you can come back with an even better business second time around. Why better? Because, once you’ve run a business, business ideas start flowing and can’t be stopped…

Will Microsoft Word and Excel become obsolete?

According to new Deloitte research, about 52% of respondents considered AI agents systems and 42% believed multi-agent systems were the technology that would “drive the future”. So what is an AI agent? Will you have to use AI agents in your job?

So here’s the thing about AI (short for Artificial Intelligence): When people talk about AI, they are usually referring to Large Language Models (LLMs). LLMs predict what word comes next, so the more words they are ‘trained’ on, the better are their predictions. This is where the ‘Large’ in LLMs comes from. Being large, LLMs need lots of computing power, which is why you normally need to connect to the Cloud in order to use them. By contrast. Small Language Models (SLMs) are small enough to fit on small devices like an iPhone, but their accuracy suffers.

Because LLMs (and SLMs) predict the next word and the word after that and then the next word and so on, they aren’t actually intelligent and have no ‘understanding’ of what they are saying. This is why they are usually helpful, but can get things badly wrong.

Anyway, back to AI agents: Satya Nadella, the CEO of Microsoft drew a lot of attention to AI agents recently (Dec 2024), by saying the “notion that business applications exist” could “collapse” with the arrival of AI agents and went on to explain that applications are basically a (graphical) user interface that uses business logic to interface to a database. In this sense, at some time in the future, an end user may use plain English to tell an AI what it wants. The AI then acts as an agent for the end-user by creating the user interface and setting up the business logic to interface with any database housing the required data.

In other words, everyone may end up using AI agents, instead of the programs we’ve grown up with (like Word and Excel), not just IT specialists.

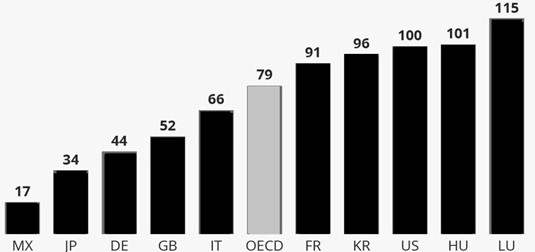

Pensions for freelancers vary greatly from country to country

Financial security in old age is a particular challenge, not only for freelancers in Hong Kong. A recent analysis by the OECD reveals significant differences between the pension systems of different countries and their impact on freelancers.

On average, self-employed people in OECD countries receive a pension, that is 79 percent of the state pension of an employee. However, this hides major differences between individual countries.

In Mexico, freelancers receive just 17 percent of the pension of their employed colleagues. Germany also performs below average at 44 percent. In the United Kingdom, the figure is slightly higher at 52 percent.

In some countries, freelancers are even better off than pensioners: In Hungary and the United States, the level is 100 percent, while in Luxembourg freelancers receive 1.15 times the pension.

The differences between countries are mainly due to the different rules on contribution obligations in income-related pension systems. In 13 of the 39 OECD countries examined, self-employed people have to pay both employee and employer contributions.

In 12 countries, freelancers pay lower contributions, but this results in limited pension coverage. Colombia, Greece, Poland and Spain have lower flat-rate contributions for the self-employed. Ireland, the Netherlands and the United Kingdom only require a compulsory contribution to the basic pension.

In Australia, Denmark and Germany, compulsory contributions for the self-employed are completely eliminated. New Zealand is the only country with no compulsory contributions for either group.

In other words, freelancers aren´t required to put any of their earnings into superannuation. Having said this, it would be prudent to at least try to match the Super Guarantee percentage of 11.5% (increasing to 12% from 1 July 2025).”

The OECD study “Pensions at a Glance 2023” is based on model calculations of the theoretical pension of the self-employed and employees. The following assumptions were used for the calculations:

• Equal taxable income (average net wage before tax).

• Full-time employment from the age of 22 without interruptions.

• Retirement at the average retirement age.

Freelancer joke of the month

I´m an attorney, working on my fifth freelance project.

That guy really needs to stop getting arrested.

If you have suggestions or want to subscribe to our newsletter, please leave your message here: