Pensions for freelancers vary greatly from country to country

Financial security in old age is a particular challenge, not only for freelancers in Hong Kong. A recent analysis by the OECD reveals significant differences between the pension systems of different countries and their impact on freelancers.

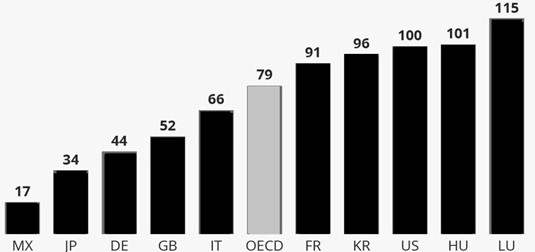

On average, self-employed people in OECD countries receive a pension, that is 79 percent of the state pension of an employee. However, this hides major differences between individual countries.

In Mexico, freelancers receive just 17 percent of the pension of their employed colleagues. Germany also performs below average at 44 percent. In the United Kingdom, the figure is slightly higher at 52 percent.

In some countries, freelancers are even better off than pensioners: In Hungary and the United States, the level is 100 percent, while in Luxembourg freelancers receive 1.15 times the pension.

The differences between countries are mainly due to the different rules on contribution obligations in income-related pension systems. In 13 of the 39 OECD countries examined, self-employed people have to pay both employee and employer contributions.

In 12 countries, freelancers pay lower contributions, but this results in limited pension coverage. Colombia, Greece, Poland and Spain have lower flat-rate contributions for the self-employed. Ireland, the Netherlands and the United Kingdom only require a compulsory contribution to the basic pension.

In Australia, Denmark and Germany, compulsory contributions for the self-employed are completely eliminated. New Zealand is the only country with no compulsory contributions for either group.

In other words, freelancers aren´t required to put any of their earnings into superannuation. Having said this, it would be prudent to at least try to match the Super Guarantee percentage of 11.5% (increasing to 12% from 1 July 2025).”

The OECD study “Pensions at a Glance 2023” is based on model calculations of the theoretical pension of the self-employed and employees. The following assumptions were used for the calculations:

• Equal taxable income (average net wage before tax).

• Full-time employment from the age of 22 without interruptions.

• Retirement at the average retirement age.

If you have suggestions or want to subscribe to our newsletter, please leave your message here:

This article was published in the Freelancing.HK-News 76.